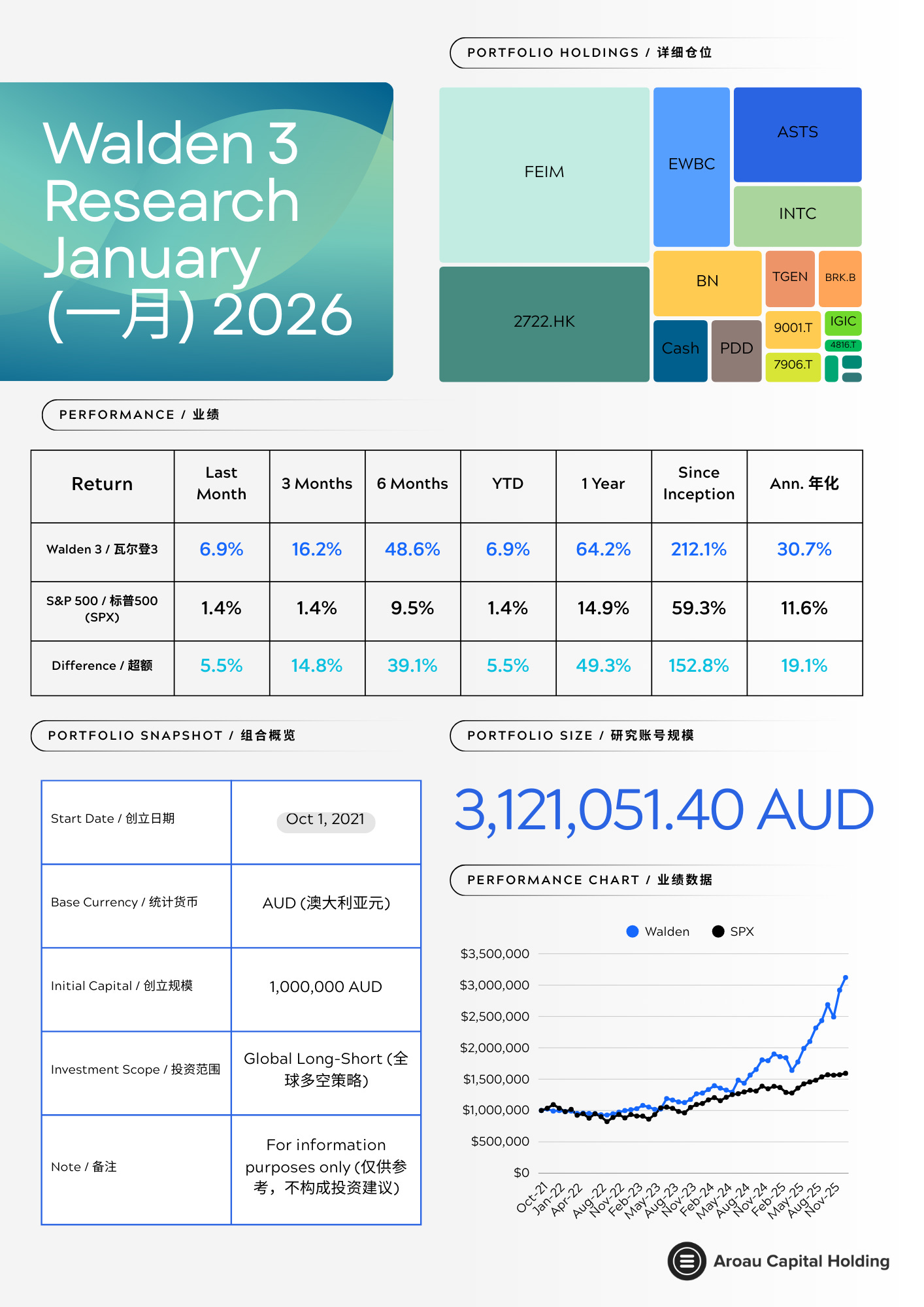

January Portfolio

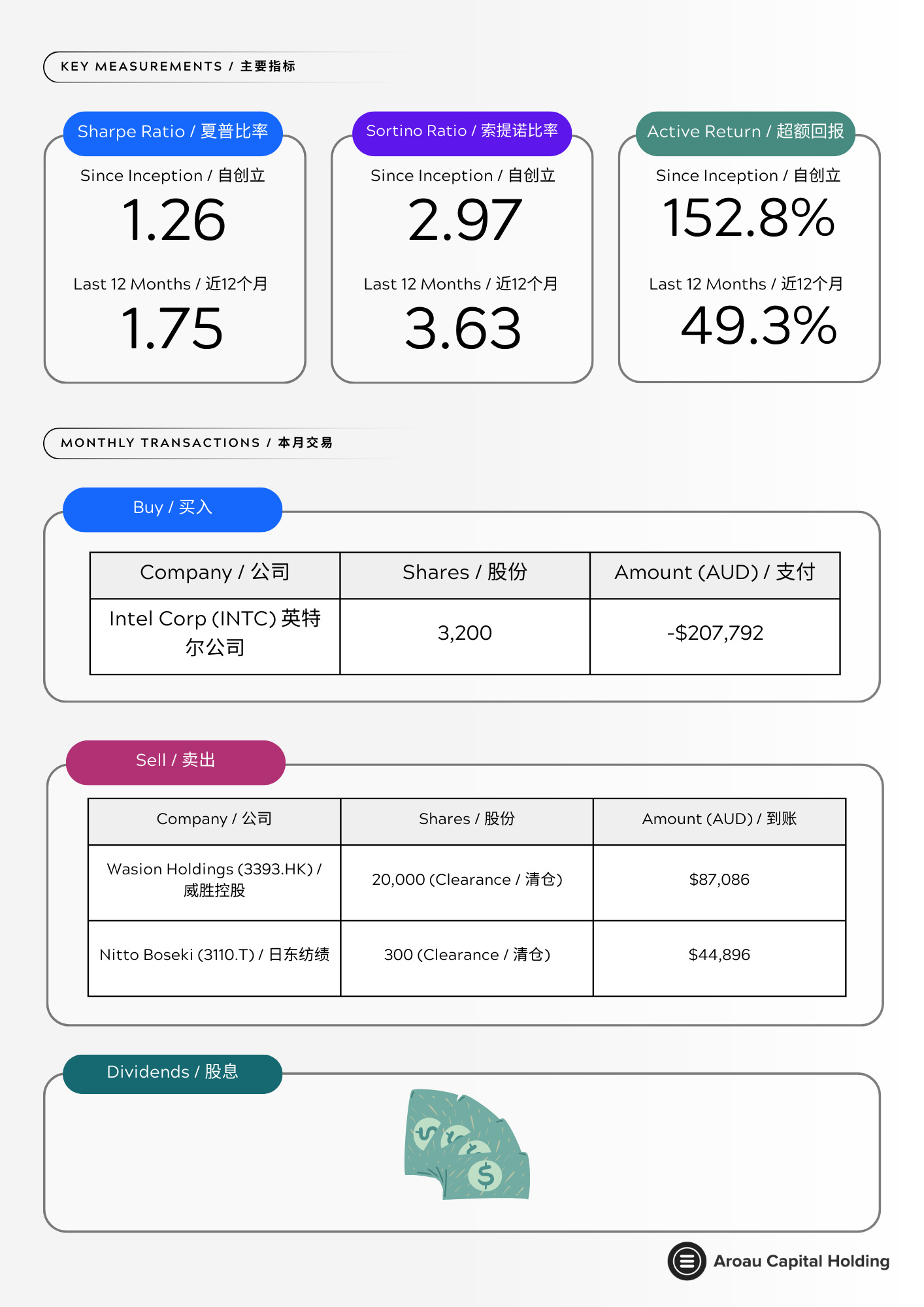

Buy INTC Sell 3393.HK, 3110.T

Monthly Summary

The portfolio returned +6.9% in January against the S&P’s +1.4%. It was a favorable month, though we’d caution against reading too much into short term results; a single month tells you almost nothing about whether the underlying process is sound.

Most of January’s gains came from two positions: Chongqing Machinery, which finally started getting attention after a long stretch of being ignored, and AST SpaceMobile, which continued its post launch momentum. We also saw meaningful weakness in Tecogen and some give back in Frequency Electronics after its December run. Net net, a decent month, but we’re mindful that concentrated portfolios can swing either way quickly.

The more interesting story this month was the portfolio rotation: we exited Wasion Holdings and Nitto Boseki after both reached our fair value estimates, and redeployed that capital into Intel. The thinking behind that trade is worth discussing in detail.

Portfolio Activity

New Position: Intel (INTC)

Action: Bought 3,200 shares

We built this position across two tranches; some early in the month, the rest after the post earnings pullback on January 24. This is a long term bet, and we wanted to be thoughtful about entry rather than rushing in.

The Thesis:

We think of this as a bet on American high end manufacturing over the long term. Two factors make Intel interesting at current prices.

First, Lip Bu Tan. He built Cadence into what it is today, and his track record on operational turnarounds is hard to argue with. When someone of his caliber takes a CEO role at a company like Intel, it suggests he sees a credible path forward. His approach, tight focus on engineering, cutting bureaucracy, aligning incentives, seems well suited to what Intel needs right now. Whether he can actually execute is an open question, but we’re willing to bet on his track record.

Second, the CPU angle on AGI infrastructure. Everyone’s focused on GPUs, understandably, but the AGI buildout also requires substantial CPU capacity for orchestration, data preprocessing, and inference serving. Intel is one of the few companies globally that can manufacture leading edge CPUs at scale, and it is the only one doing it domestically in the US. As hyperscalers race to build out AGI infrastructure, we think CPU demand could surprise people. That said, this is admittedly speculative; we could be wrong about the magnitude and timing.

At our blended entry price, Intel is about 2.0x book value based on FY2025 reported equity and shares outstanding. The market still seems skeptical about the company’s future earnings power and execution. We acknowledge the bear case is reasonable; TSMC and Samsung have real leads in leading edge manufacturing, and turnarounds in semis are notoriously difficult. Position sizing at 6.8% reflects both our conviction and our uncertainty: meaningful enough to matter if we’re right, but not so large that we can’t absorb being wrong.

Exits

Wasion Holdings (3393.HK)

Action: Sold all 20,000 shares

Wasion reached our estimate of fair value after a steady re rating over the past year. The original thesis, China grid modernization beneficiary trading at a discount, played out roughly as expected. At current prices, the remaining upside requires either multiple expansion or earnings acceleration, neither of which we can underwrite with confidence. Seemed like a reasonable time to harvest gains and move on.

Nitto Boseki (3110.T)

Action: Sold all 300 shares

We bought Nitto in December as a small bet on semiconductor supply chain stickiness. The stock appreciated to our target faster than expected, roughly a month. Rather than revising our target upward to justify continued holding (a behavioral trap we’ve fallen into before), we took the gains. Some of this was probably luck; the timing worked out, but we didn’t have any special insight into when the re rating would happen. The proceeds helped fund the Intel position.

Position Commentary

What Worked This Month

Chongqing M&E (2722.HK) | +34.6%

After a long period of being overlooked, 2722 started attracting some attention in January. The market seems to be recognizing the business mix shift we’ve been watching; less legacy machinery, more UHV transformer work and Cummins JV gensets. Whether this move is sustainable or just a temporary bounce, we honestly don’t know. The fundamentals look fine to us, but H share sentiment can be fickle. We’re staying patient and letting the thesis play out.

AST SpaceMobile (ASTS) | +53.1%

ASTS continued its run from December’s successful BlueBird 6 launch. The stock is pricing in reduced execution risk now that actual hardware is in orbit. This feels like learned appreciation in the sense that they’re delivering real progress, not just slide decks. That said, a lot still has to go right for this to work; the 2026 launch campaign, commercial service rollout, and so on. We remain holders, but this is inherently a high uncertainty position.

East West Bancorp (EWBC) | +1.8%

EWBC continued its quiet grind. This isn’t a position we expect to generate headlines; it’s here to compound tangible book value steadily through its US Asia commercial banking niche. The small monthly gain is consistent with what we expect from this type of holding.

What Didn’t Work

Tecogen (TGEN) | (24.3%)

TGEN remains a frustrating position. The thesis, data centers need distributed, resilient power generation, still makes sense to us conceptually, but execution has repeatedly disappointed. The stock gave back most of its 2H 2025 gains. We’re reviewing the position honestly and asking whether management can deliver. Our conviction has weakened.

Frequency Electronics (FEIM) | (2.3%)

Some consolidation after December’s sharp move was expected. As we noted last month, gains of that magnitude in illiquid microcaps often reflect liquidity dynamics as much as fundamentals. The stock likely got ahead of actual business delivery. From here, performance needs to be earned through execution rather than sentiment. We remain holders given the contract visibility, but acknowledge we’re in a show me phase now.

PDD Holdings (PDD) | (10.9%)

PDD faced pressure on Temu regulatory concerns; the de minimis tariff exemption that enables their low cost model is under political scrutiny in multiple jurisdictions. At 2.8% of the portfolio, this is sized as an option on China consumer recovery with meaningful tail risk. The decline is within our expected volatility band, but we’re watching the regulatory situation closely.

Portfolio Positioning

The Wasion and Nitto proceeds funded the Intel purchase. We’re holding about 3% cash, which provides some flexibility if interesting opportunities emerge.

The portfolio remains concentrated; top five positions represent about 78% of NAV. This is intentional but also means returns will be lumpy. Concentrated portfolios can work well when you’re right and poorly when you’re wrong. We try to size positions to reflect our conviction while maintaining enough diversification to survive mistakes.

Looking Ahead

We don’t have strong views on near term market direction. The portfolio is positioned around company specific situations that we believe can work regardless of the broader tape, though of course everything correlates in a real downturn.

Things we’re watching: ASTS launch execution through 2026, Intel’s progress on 18A under Lip Bu Tan, and whether 2722’s January move reflects genuine discovery or just noise. On the risk side, TGEN is on a short leash, PDD’s regulatory situation remains fluid, and our largest position (FEIM) needs to convert its backlog into actual revenue.

The usual caveats apply: concentrated portfolios are volatile, past returns don’t predict future results, and we’ll inevitably be wrong on some of these. We try to stay humble about what we don’t know while remaining disciplined about our process.